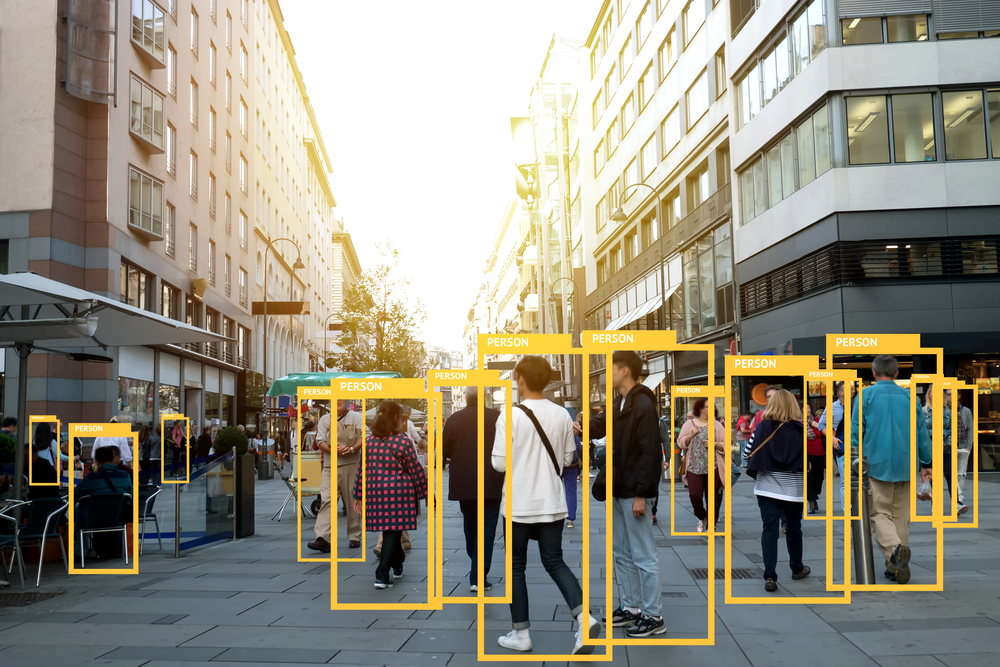

CALIFORNIA - US economist Larry Summers once took exception to former US Treasury Secretary Steven Mnuchin’s views on artificial intelligence (AI) and related topics. The difference between the two seems to be, more than anything else, a matter of priorities and emphasis.

Mnuchin takes a narrow approach. He thinks the problem of particular technologies called “artificial intelligence taking over American jobs” lies “far in the future.” And he seems to question the high stock-market valuations for “unicorns” – companies valued at or above US$1 billion that have no record of producing revenues that would justify their supposed worth and no clear plan to do so.

Summers takes a broader view. He looks at the “impact of technology on jobs” generally, and considers the stock-market valuation for highly profitable technology companies such as Google and Apple to be more than fair.

I think that Summers is right about the optics of Mnuchin’s statements. A US treasury secretary should not answer questions narrowly, because people will extrapolate broader conclusions even from limited answers. The impact of information technology on employment is undoubtedly a major issue, but it is also not in society’s interest to discourage investment in high-tech companies.

On the other hand, I sympathize with Mnuchin’s effort to warn non-experts against routinely investing in castles in the sky. Although great technologies are worth the investment from a societal point of view, it is not so easy for a company to achieve sustained profitability. Presumably, a treasury secretary has enough on his plate without having to wo

The content herein is subject to copyright by Project Syndicate. All rights reserved. The content of the services is owned or licensed to The Yuan. The copying or storing of any content for anything other than personal use is expressly prohibited without prior written permission from The Yuan, or the copyright holder identified in the copyright notice contained in the content. Continue with Linkedin

Continue with Linkedin

Continue with Google

Continue with Google

5695 views

5695 views